Property Tax Appeal Service

Frequently Asked Questions

How do I know if I should protest?

First, you need to know if your tax appraisal is fair. Find out by running an Evaluation on your address.

If your Evaluation finds strong evidence indicating your valuation is excessive, we’ll recommend moving forward with your protest. Read more about the evidence required for a protest.

If we can’t find substantial evidence indicating you’re over-assessed, we’ll let you know up-front with a message like the one below:

How do you determine if my home may be over-assessed?

- We must find substantial evidence.A property evaluation must identify five or more comparable properties demonstrating inequity with how your home and others are assessed on a per-square-foot basis.

- Comps must have similar physical characteristics.Comps chosen for inclusion must closely resemble the subject by meeting a strict set of size, age, and grade parameters.

- Comps must be nearby. Comps must be located within the boundaries of the neighborhood code assigned by the Appraisal District to the subject property.

- Comps must be adjusted. Comps must be properly adjusted to account for differences in condition, age, and grade before being considered as evidence.

Significant potential reduction must exist. The Median Value of the qualified set of adjusted comparable properties must support potential tax savings that exceed the purchase price of the Evidence Package.

We will not recommend a protest if any one of these five standards are not met. These requirements ensure that only qualified individuals pursue an appeal and

Which methods do you use to determine my value?

We check your property for potential savings by performing an Assessment Comparable Analysis and a Comparable Sales Analysis.

- The Assessment Comparable Analysis; sometimes referred to as Equity Analysis, compares your property assessed value with the assessed values of similar homes in your neighborhood.

- The Comparable Sales Analysis compares your homes assessed value with sale prices of similar houses in your neighborhood.

Per appraisal standards, both analyses make adjustments for physical differences between the subject and comparable properties.

I purchased my home within the last year for less than my tax assessment. Do I still need this?

Probably not. If you purchased your home within the 12 months preceding January 1 of the current year for LESS than your tax value, we recommend providing a signed copy of your closing statement. As long as it was an open-market transaction, it will likely be viewed as the best indicator of Market Value.

Is there anything else I can provide to help win my appeal?

- Include pictures. Provide even more data by including pictures showing the condition of your home. If you are trying to prove your home is in worse condition than the typical home in your neighborhood, it is always helpful to have photo evidence to support your claims

. - Need home repairs? Provide a bid. It’s definitely helpful to describe needed repairs to the appraisal district, but it’s even more powerful if you can provide a bid to show exactly how much it should impact your valuation

. - Learn the protest process. Most appeals are settled at the

Online, or Informal level. If the appraisal district does not make an offer you agree to accept at the Informal level, your case goes to an Appraisal Review Board (ARB), which consists of 3 impartial citizens.

Why can't I find my address?

- Your property must be a single-family residential home.

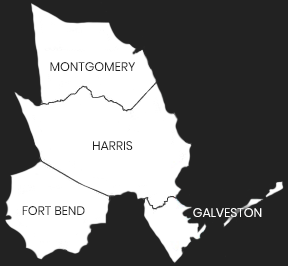

- Your property must be located in Harris County, Fort Bend County, Galveston County, or Montgomery County.

- Ensure that your appraisal district did not issue your initial value at a later date than other properties in your county. If you think this may be the case, Contact Us to be notified when your property is supported.

- Your property may not appear in our system if it was constructed in the last year.

What does it mean to be Unequally Appraised?

41.43. PROTEST OF DETERMINATION OF VALUE OR INEQUALITY (b) A protest on the ground of unequal appraisal of property shall be determined in favor of the protesting party unless the appraisal district establishes that:

- the appraisal ratio of the property is equal to or less than the median level of appraisal of a reasonable and representative sample of other properties in the appraisal district;

- the appraisal ratio of the property is equal to or less than the median level of appraisal of a sample of properties in the appraisal district consisting of a reasonable number of other properties similarly situated to, or of the same general kind or character as, the property subject to the protest; or

- the appraised value of the property is equal to or less than the median appraised value of a reasonable number of comparable properties appropriately adjusted.

What happens after I purchase my evidence package?

Immediately after purchase, a link will be provided to download your Evidence Package. We’ll also include the instructions

Will this negatively impact my homes sale price if I decide to sell?

No, in fact, your home can actually bring a higher selling price if you regularly contest your property taxes. This is due to the lower cost of ownership achieved when the valuation is regularly kept in check. Imagine this: You’re deciding between House A and House B. They are next door to each other and completely identical. The seller of House A regularly protested their property taxes and is assessed at $220,000. Their tax bill will be $5,500. The seller of

When is the deadline to file a property tax protest in Texas?

In previous years, the protest deadline was May 31. Starting in 2018, the protest deadline in Texas for most people is May 15th. If you received your Notice of Appraised Value after April 15th, you have 30 days from the date on the Notice to file your protest.

What is the difference between my Appraised Value and Market Value?

Your Market Value represents what the appraisal district believes your home could be sold for on the open market as of January 1st of the tax year in question.

How are property taxes calculated?

What are the basics of the property tax system in Texas?

What is a property tax protest?

Claim Your Property Tax Report!

100% RISK-FREE GUARANTEE

We guarantee success when using your report, or your money back!

Powered by Rainbolt & Co.

12930 Dairy Ashford Rd, Suite 901

Sugar Land, TX 77478

Hours: Mon-Fri 9AM - 5PM

Phone: 713-338-2308