Property Tax REDUCTION

Recent Blog Articles

Property Tax Protest Deadline – May 15th, 2018

Please note there have been some changes in the law this year. Most importantly, the property tax protest deadline now falls on May 15th instead of May 31st. The 2018 Notices of Appraised Value will be mailed throughout March and April. If you believe your property...

Home Values & Property Tax Tips

Over the last two years, Houstonians have experienced significant growth in their home values with average prices up 20-30% in some areas. While this is good news for many, it does not come without its downside. The associated growth in property tax assessments...

2015 Property Tax Appraisal Protests in Harris County (HCAD)

HCAD has increased the property tax assessments of Houston area property owners again in 2015. Hundreds of thousands of Harris County homeowners will receive their Notice of Appraised Value in the mail.  Many Houstonians may be surprised to see their property...

Appeal Property Tax in Texas – Protest deadline May 31

April and May are important months for homeowners seeking to minimize their taxes by filing a property tax appeal. The appraisal district values will be completely released throughout the month of April. Property tax protests must be submitted by May 31. Find out if...

Contesting property tax appraisals in Harris County

Most of the Harris county values are available, however some are still pending. For this reason, our system is loaded with 2013 values until all the 2014 values are released. Find out if you're over-paying and we'll automatically analyze your property and email the...

Appeal HCAD Property Tax Value

Over the next couple weeks, Houston-area taxpayers will receive their 2014 Notices of Appraised Value in the mail. For most homeowners, HCAD's 2014 appraised values will increase their property tax liability by 10% over 2013. Â Last year, about 30% of all Houston...

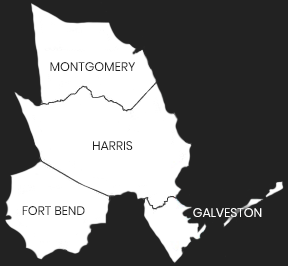

Galveston County Property Tax Protest

Galveston Central Appraisal District's online property tax protest platform allows homeowners to file and settle their property tax protest online. The system is attractive to homeowners, since many people lack the time to appear in-person for both the informal &...

Protest Montgomery County Property Tax in minutes

Montgomery Central Appraisal District's online property tax protest platform allows homeowners to file and settle their property tax protest online. The system is attractive to homeowners, since many people lack the time to appear in-person for both the informal...

Protesting Property Tax in Fort Bend County – FBCAD

Fort Bend Central Appraisal District's online property tax protest platform allows homeowners to file and settle their property tax protest online. The system is attractive to homeowners, since many lack the time to appear in-person for both the informal & formal...

Considering HCAD’s iFile & iSettle system?

HCAD iFile and iSettle are Harris County Appraisal District's online property tax protest platforms. iFile is used to file your protest and iSettle is used to settle your protest. Many homeowners lack the time to appear in-person for both the informal & formal...

100% RISK-FREE GUARANTEE

We guarantee success of your protest or your money back!

Powered by Rainbolt & Co.

12930 Dairy Ashford Rd, Suite 901

Sugar Land, TX 77478

Hours: Mon-Fri 9AM - 5PM

Phone: 713-338-2308