Property Tax Protest Deadline – May 15th, 2018

Please note there have been some changes in the law this year. Most importantly, the property tax protest deadline now falls on May 15th instead of May 31st.

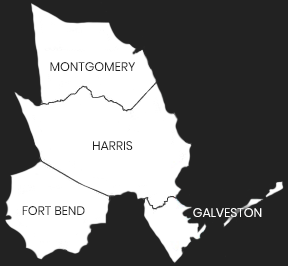

The 2018 Notices of Appraised Value will be mailed throughout March and April. If you believe your property assessment might be too high, you can run a free Tax Assessment Evaluation on our website to see if comparable assessment and sales data support a reduction. Our system will be loaded with the 2018 appraisal data as soon as it’s available for the majority of properties within Harris, Fort Bend, Montgomery, and Galveston counties.

100% RISK-FREE GUARANTEE

We guarantee success when using your report, or your money back!

Powered by Rainbolt & Co.

12930 Dairy Ashford Rd, Suite 901

Sugar Land, TX 77478

Hours: Mon-Fri 9AM - 5PM

Phone: 713-338-2308