FIGHTING PROPERTY TAX IN 2013 | HCAD 2013 VALUE INCREASES

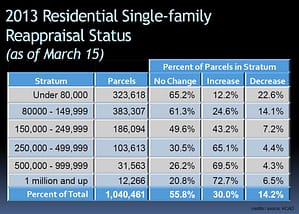

Property tax protestors may find more reasons to fight their property tax assessment in 2013 as opposed to last year, when the vast majority of home assessments remained relatively flat. Â As seen by the chart below, on average, about 30% of property tax assessments were increased. Â This contrasts with 2012, when the percent of residential properties increased was closer to 10%. We expect property tax appeals to follow a similar trend, since increased assessments naturally trigger more protests from homeowners seeking to reduce their tax liability.

The majority of homes under $250,000 remained unchanged, while roughly 67,452 (65.1%) of the 103,613 homes in the $250,000-$499,999 increased. Â Similarly, 21,936 (69.5%) homeowners in the $500,000-999,999 range were dealt increases and 8,917 (72.7%) of homes over $1,000,000 were raised.

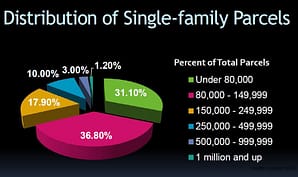

The distribution of single family parcels in Harris County is shown below (according to HCAD). Â Roughly 893,019 homes (85.8% of the total number of parcels)Â make up the residential sector of the tax base that is assessed below $250,000.

Wondering if you should protest property taxes? Â PropertyTaxReduction’s online assessment tool will tell you “YES” or “NO” as to whether or not you should file an appeal. Â The determination is made by an analysis of the availability of evidence that would likely result in a successful property tax protest.

Live in a county other than Harris? Protesting property tax in Fort Bend County (FBCAD), Brazoria County (BCAD), Montgomery County (MCAD), and Galveston County (GCAD), is easy too. Our evaluation tool works in for residential properties in these counties as well, and will give you a very good idea of your likelihood of success.