Appeal HCAD Property Tax Value

For most homeowners, HCAD’s 2014 appraised values will increase their property tax liability by 10% over 2013.  Last year, about 30% of all Houston single-family residential properties’ assessments rose, with higher valued homes experiencing steeper increases.

The trend continues for 2014, only this year roughly 80% of taxpayers will be cutting a bigger check to pay their property taxes. Â Homes above $500,000 have been hit particularly hard beginning in 2013, with many now facing two consecutive years of significant increases in their tax assessments.

As a homeowner, it’s important that you don’t blindly accept an increase in your assessed value, because often the prior year’s assessment is the baseline for the next year’s increase. Â If there is strong evidence that contradicts the appraisal district’s opinion of value, you stand a good chance of reducing your tax burden by filing a property tax protest. Savvy homeowners know this, and participate in the protest process to minimize the cost of owning their home and save significant dollars year-over-year.

For example, consider a home assessed at $500,000 in 2012 that experienced a 10% increase in 2013, followed by another 10% increase in 2014. As a result of these increases, the owner of this home will end up paying nearly $4000 more in taxes. Assuming a standard 2.5% tax rate, the tax liability in 2012 would be $12,500.  In 2013, the taxes would increase to $13,750; and in 2014 the property taxes would cost $15,125!  Many homeowners who don’t file a protest may soon find themselves in a similar situation when the expected 2014 increases are issued.  Time will tell what impact these increasing property taxes (coupled with rising interest rates) will have on the Houston housing market.

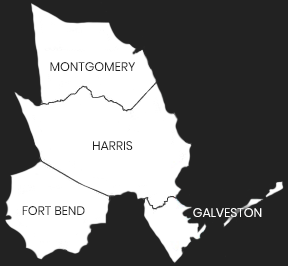

Each year when you receive your tax appraisal notice, you should start by checking the appraisal district’s valuation to see if the comparable property assessments and market sales data really supports their value. Â Our assessment evaluator searches your neighborhood and analyzes every similar property’s assessment and recent sale prices and tells you if appealing your property tax assessment is likely to save you money. Â Performing this analysis is an easy and effective way to ensure you don’t overpay, can save you time, and ultimately lock in savings for years to come.

100% RISK-FREE GUARANTEE

We guarantee success of your protest or your money back!

Powered by Rainbolt & Co.

12930 Dairy Ashford Rd, Suite 901

Sugar Land, TX 77478

Hours: Mon-Fri 9AM - 5PM

Phone: 713-338-2308